Sales of electric motorcycles and scooters in Europe show a decline in the first six months of 2023. The growth trend of recent years seems to have reached a stopping point, at least in the first half of 2023.

Sales of electric motorcycles and scooters in Europe in the first six months of 2023 – Judging by the data for the first half of 2023, Europeans are still buying electric motorcycles and scooters but less than industry players expected. This phenomenon is evident in several countries, with Italy, Holland and France registering double-digit percentage reductions.

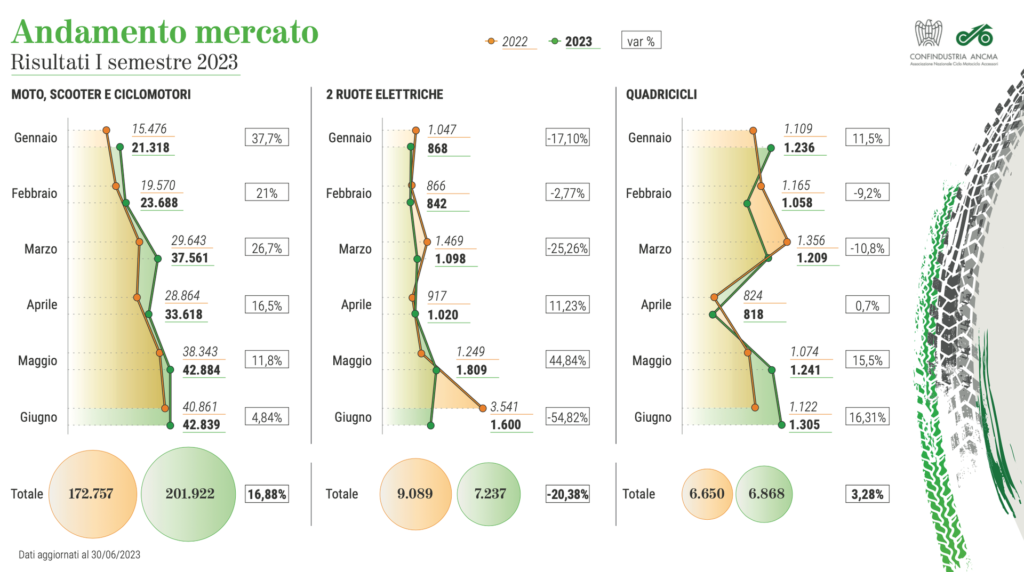

Italians, for example, bought 1.484 fewer units in the first six months of the year, a 16% drop compared to the same period of the previous year. France registered 2.409 fewer units than in 2022, with a drop similar to that recorded in Italy. On average in Europe, electric two-wheelers registered in the first six months were 20% less than in 2022.

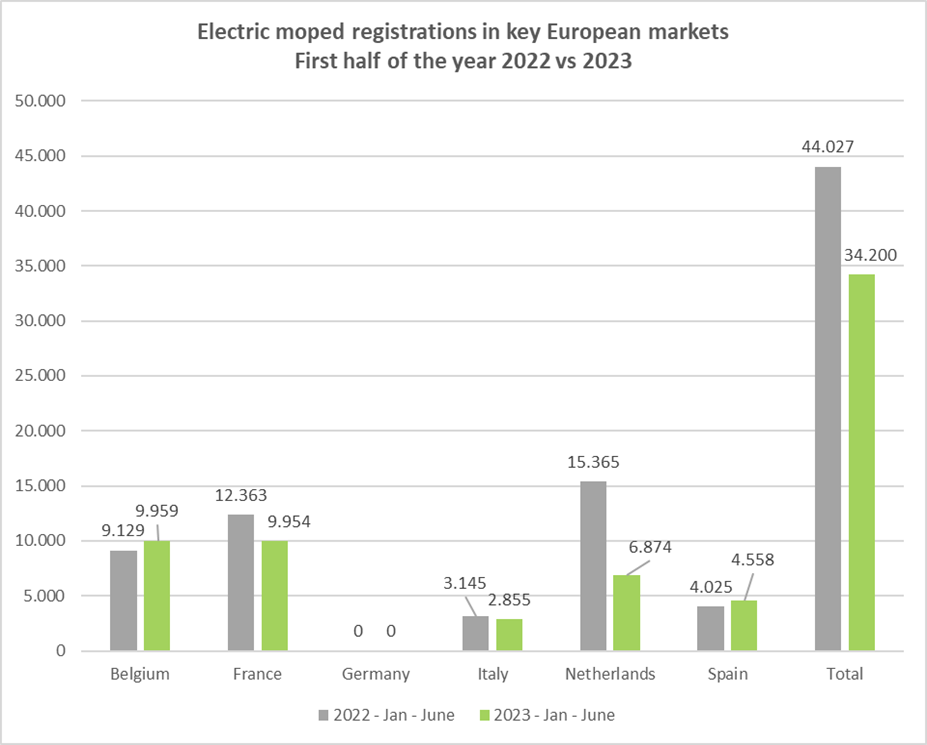

In the electric motorcycle sector (models equivalent to a 1255cc petrol engine or higher), the decline was less marked (-8%), with 19.375 units sold between January and June 2023. The sector that recorded the greatest decline was that of electric mopeds, with 34.200 units sold, 22% less than in the first six months of 2022.

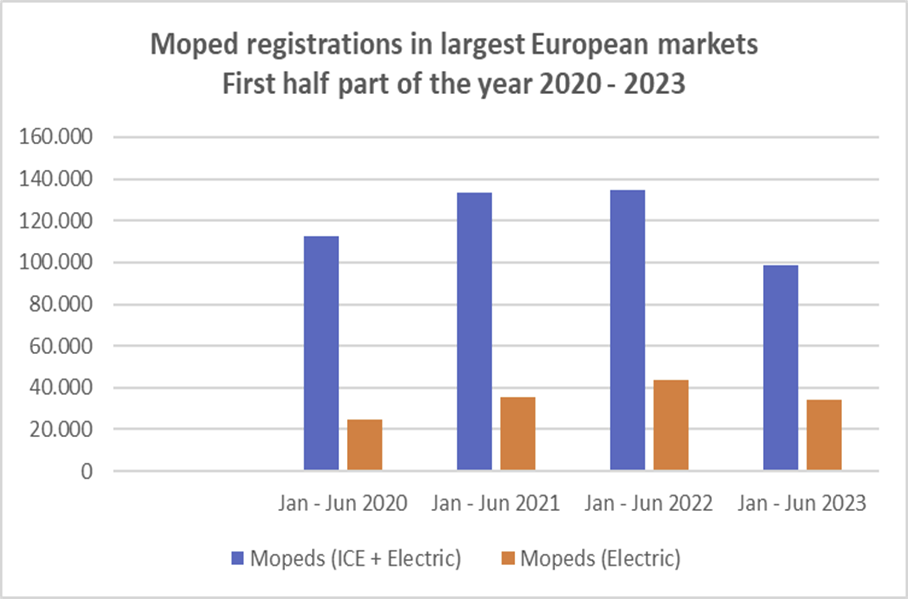

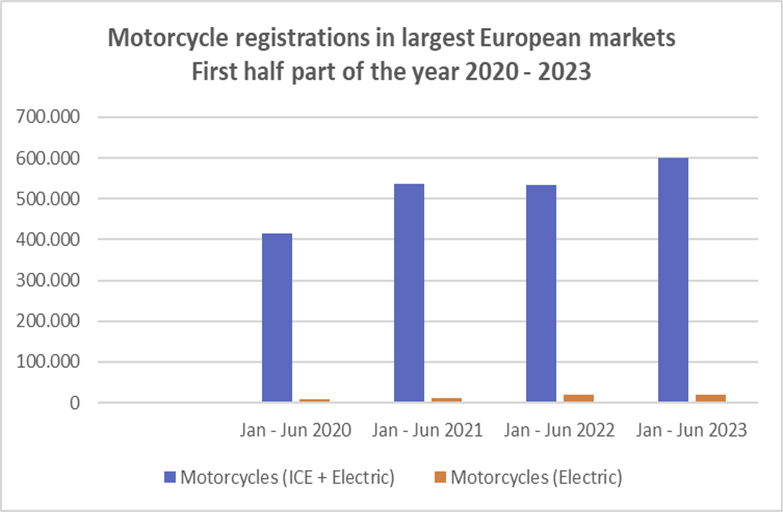

These data, apparently negative, must be read in a context in which mopeds in general are declining and not just those with electric propulsion. Internal combustion mopeds in the first six months of 2023 fell by 28%. On the other hand, the trend of motorcycles is different, which in the first half of 2023 increased by 11% to over 600.000 units, marking a constant growth in 2020 when the units sold in six months had been just over 400.000.

Returning to electric vehicles, mopeds represent the sector from which the greatest growth was expected. At the end of 2022 there were those who predicted that electric mopeds would overtake thermal ones by 2023, while the data for the first six months of 2023 tell us that the former represent only 20% of the total mopeds sold. What are the causes of this stop?

Some speculate a lack of supply, with supply problems and deliveries lasting several months. However, this assumption does not find much foundation.

Not even eco-incentives seem to have played a role in the drop in sales. In Italy, the incentives for electric mopeds were paid in both 2022 and 2023 in similar ways; difficult to find in this item the reasons for a decline in sales throughout Europe.

Beyond possible contingent causes, difficult to hypothesize on a market as large as the European one, the research seems to focus more on system reasons. Those who were inclined to buy an electric two-wheeler have already had the opportunity to buy it in the last two years, taking advantage of government incentives and discounts from dealers. Now that the pioneers already own an electric moped, different tools are needed to reach users who are more skeptical or less informed about electric mobility.

For this, the electric sales network needs to find different forms. The multi-brand dealership that sells thermal and electric motor vehicles doesn't work for the latter. The business model of these realities is heavily based on after-sales and maintenance services linked to traditional vehicles. An electric vehicle doesn't need as frequent maintenance as a thermal one, which makes it unattractive for a dealership that sells both products.

If we move to observe the marketing model of two-wheeled electric vehicles, it is evident that at the moment it is very weak: it does not promote a new idea in which the user can identify with, but replicates that of traditional vehicles. How should a potential customer see themselves on an electric scooter? What does an electric two-wheeler represent in your eyes? Resorting to the current influencer who already promotes a myriad of products and who creates yet another post in which he is sitting on an electric scooter seems too weak an answer.

The advertising of electric vehicles is in fact often limited to social channels, most of the time it reaches those who already know about electric vehicles, resulting in little effectiveness in expanding the market.

Finally, the presence of a myriad of brands in the electric two-wheeler sector is not an advantage, on the contrary. This is accompanied by the lack of traditional brands, an element that does not help to perceive the value of the electric vehicle. The absence of the historic two-wheeler brands, understandably the least inclined to move away from the thermal business model, leaves potential customers perplexed who see a lower value of the electric vehicle in this absence. And here the ability to give an answer to the question becomes fundamental: what should a two-wheeled electric vehicle represent in the eyes of the customer? The number of electric vehicles we will see in cities in the coming years will depend on the ability to formulate an answer to this question.

Source: ACEM

To be updated on MotoE World Cup, subscribe to Epaddock's Whatsapp broadcast and receive all our news on your mobile phone in real time: find out how here.